Car Insurance Policy Third Party Fire and Theft

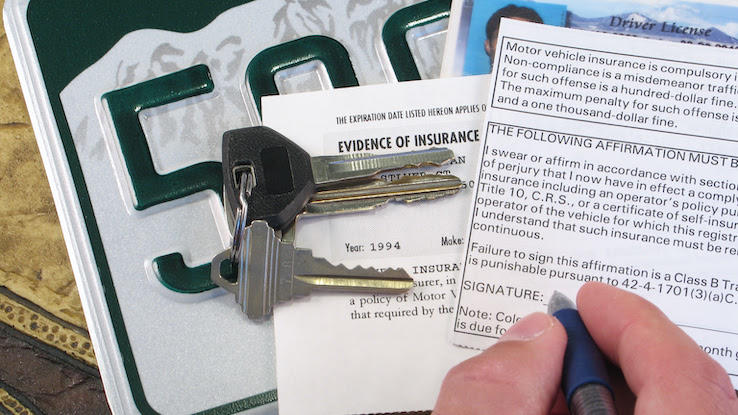

It's no secret that car insurance can get complicated. Every insurance company offers several different types of policies and a variety of coverage limits that can change based on where you live, what kind of driver you are, what you want to purchase and what the state where you live requires. One type of automobile insurance coverage that nearly every driver needs is called third-party insurance.

Third-party insurance is legally required in most states, and, like other forms of insurance, it can help protect drivers from some of the most expensive risks involved with owning and operating a car. And, again like other forms of insurance, third-party policies can differ in what they cover and how. If you need to purchase a third-party policy, or if your current auto policy already includes it and you're interested in how it protects you, it's wise to learn the basics of what third-party insurance is and how it works.

Third-party auto insurance is often referred to as liability coverage. This type of insurance gets its name because it protects a third party in the event of an accident. When it comes to insurance, you're the first party, your insurer is the second party and someone who files a claim against you for damages is the third party.

Consider the following scenario. Jamari has an auto insurance policy with Cars4All Insurance. Jamari is the first party, and Cars4All is the second party. Jamari's vehicle insurance policy covers any damage he causes to another person's car or property. When Jamari gets in a car accident and totals Nita's car, Nita files a claim against Jamari's policy. Cars4All pays for Nita's damages. Nita is the third party because Jamari's liability coverage protected her.

In the event of an accident, third-party insurance covers damages that the insured person causes to another person. This liability coverage protects a person who takes out a policy from all or a portion of the financial responsibility for damages they cause.

To utilize a third-party insurance policy, the third party who was injured or suffered property damage as a result of the policyholder files a claim against the policyholder through the policyholder's insurance company. Ideally, the policyholder will have already informed the insurance company of the accident and told their side of the story. This is why both parties exchange insurance information in an accident.

What Does Third-Party Insurance Cover?

There are two major types of third-party insurance. Bodily injury insurance covers the costs associated with any injury that the insured person causes to the third party. These costs can include medical bills, lost wages if the third party is unable to work due to the injury, and legal compensation for pain and suffering.

Suppose Nita, from the example above, broke her leg in the accident. She needed surgery and three follow-up visits with an orthopedic specialist. She was a track and field athlete, and her doctor says she cannot compete anymore. During the three months it took her to recover from her injury, she took a leave of absence from work. Jamari's bodily injury coverage in his third-party policy could compensate Nita for her time off work, pay her medical bills, and potentially even pay her for the pain and suffering resulting from her shortened athletic career.

The second type of third-party insurance coverage is property damage. This type of coverage pays for damage the insured person causes to someone's property. In an automobile accident, this might include guardrails on the road, the other party's vehicle, and any home structures, mailboxes or shrubbery that may be damaged.

Since the purpose of third-party insurance is to protect the third party, these policies don't cover the policyholder's needs. Even if Jamari was injured and damaged his car in the accident, Jamari's third-party policy wouldn't cover the cost of damage to his car or other possessions.

How to Find Third-Party Insurance Requirements by State

In most states, some form of car insurance is required to drive legally. States have their own standards for the minimum amount of coverage that is acceptable for a licensed driver to operate a vehicle on the roads. In other words, many states allow drivers to operate vehicles without protecting their own interests, but drivers must have basic third-party liability insurance to protect other drivers in the event of an accident.

The minimum coverage standard includes a combination of the types of coverage required and the minimum dollar amount of coverage that is acceptable. For example, a state can make it a legal requirement that all drivers purchase policies that provide at least $25,000 worth of bodily injury coverage and $10,000 worth of property damage coverage.

To find the types of insurance and minimum coverage amounts necessary to drive in your specific state, contact your local Department of Motor Vehicles office or visit your state's Department of Motor Vehicles website. Your state's driving department may go by a different name, such as Department of Licensing, Driver Services or Bureau of Motor Vehicles.

Some states have more lenient minimum coverage requirements than others. Because regulations vary from state to state, be sure to confirm the laws where you live — and drive carefully.

Why Is Third-Party Insurance Helpful?

Third-party insurance may protect the other party, but having it is in your best interests because it protects you financially. Driving a car is a common activity that comes with very unique and potentially very expensive risks. Whenever there's an accident, the responsible parties pay for damages, either through insurance or out of their own pockets.

One car accident could lead to medical treatment, lost wages, damage to cars and damage to mailboxes. Depending on the extent of the third party's injuries, medical costs alone could exceed the six-figure mark, and state minimums for insurance coverage are often the bare minimum amount of coverage a person actually needs. Similar to a driver with no liability coverage, a driver who doesn't have a high enough level of coverage could be held personally responsible for the difference in the policy payout amount and the actual costs of the damages to the third party.

On average, staying in the hospital for just three days can cost upwards of $30,000. Some states have bodily injury coverage minimums as low as $10,000, and this policy might not be enough to cover a short hospital stay for one person. An accident can involve a car with multiple passengers or even multiple cars with multiple passengers. This is why insurance companies often recommend bodily injury coverage of $100,000 or more.

Because third-party insurance is a legal requirement in almost every state, maintaining an active policy can keep you from paying additional fees associated with not following the law. Depending on the state, failure to maintain adequate third-party insurance can result in revocation of your license, license plate or vehicle registration. A robust third-party insurance policy, covering both bodily injury and property damage, is a nominal monthly cost compared to the risk of a lifetime of debt after an accident for which you're deemed at fault.

MORE FROM ASKMONEY.COM

Car Insurance Policy Third Party Fire and Theft

Source: https://www.askmoney.com/insurance/third-party-insurance-auto-policy?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex

0 Response to "Car Insurance Policy Third Party Fire and Theft"

Post a Comment